Try OfficeBlocks!

For investors, corporate occupiers and brokers, getting insights into the commercial property market is challenging. Identifying potential investment opportunities has required a lengthy process to pull together the threads, including physical site visits, talking to other players and trawling through market reports. Although the data exists, it is often unstructured and out of date by the time you get access to it.

This is where OfficeBlocks steps in.

The OfficeBlocks suite of tools collates data on tens of thousands of individual transactions and overlays political, economic and cultural trends to give a snapshot of the market conditions this week and the forecasts from this point forward. Seeing this property-level analysis you can quickly and confidentially focus in on the deals you want to pursue.

The suite, working on a continuum, structures raw data to generate value-added insights. It captures raw and objective data, then synthesises and filters it through structured models to generate quantitative results. Thus, driving qualitative insights to help you make rapid, consistent, informed decisions.

How OfficeBlocks results help your decisions

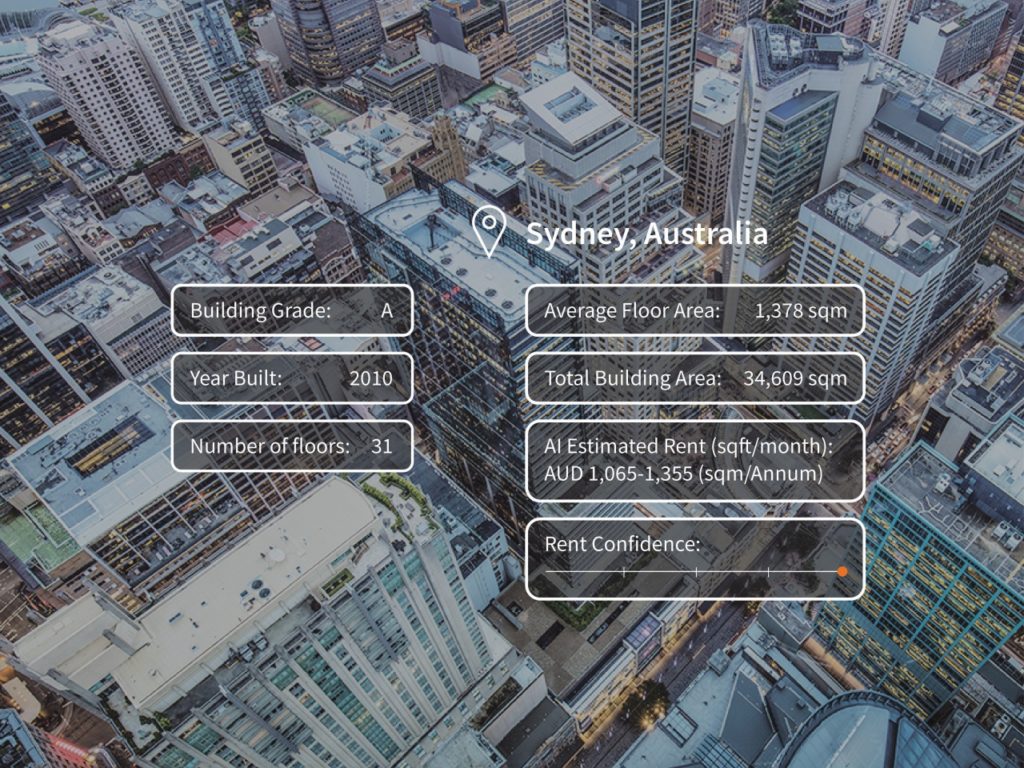

- The Market Intelligence Platform – uses AI models to structure millions of raw property data points to provide objective, property-specific estimates of rent for every office property within a market.

- The Portfolio Intelligence Platform takes decades of market data and structures it to show how each property contributes to risks and returns. The Platform can be used for strategic portfolio allocation, testing each new transaction against the strategy and communicating the strategy to management and investors.

- The Risk Intelligence Platform uses decades of market data and thousands of data points from each property and structures them through a cash flow simulation. It mirrors the commercial real estate business structure to show the range of gains and losses per year. It helps market experts identify the “cracks” in the deal and quantify the effect of changing the deal structure to eliminate the weaknesses and get the deal done with minimal risk.